TIRE STEWARDSHIP & PACE BUSINESS MANAGER

This document may apply to Pace users in other provinces but is specific to those in British Columbia.

The BC government has transferred the responsibility of collecting the tire disposal fee on all new tires sold, to a private company, Tire Stewardship BC (TSBC) http://www.tirestewardshipbc.ca/. This change took effect January 1, 2007. The industry's first remittance to TSBC will be due on February 15, 2007.

Some other provinces have already implemented a "tire stewardship" program:

New Brunswick - http://www.nbtire.com/e/001e.htm

Ontario - http://ontariotirestewardship.org/

Manitoba - http://mbtirebd.home.skyweb.ca/web.htm

The problem presented to Pace users is, (1) being able to count the number of tires, and (2) calculate the fees to be remitted for each fee category.

The rest of this document outlines (4) different methods of handling the disposal fee. A summary of advantages and disadvantages can be found at the end.

Summary Of Methods:

1. Levy System And Calculate

2. Supplier Account

3. Inventory Item

4. Levy System And SQL

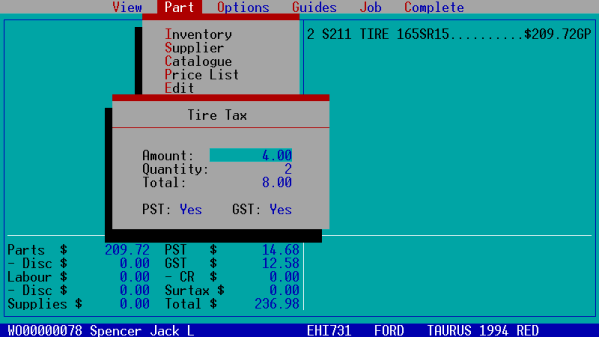

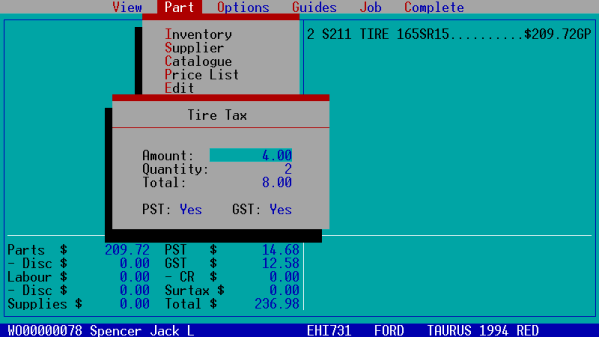

Note: The "Levy" system is simply, the standard method built-into PACE which is done on a work order via the "Parts" menu.

1. Levy System And Calculate Method

This first method is the simplest solution because it does not require any change in procedure at the front counter, although the bookkeeper will have to assume that the correct amount is charged on each sale.

Remittance Procedure:

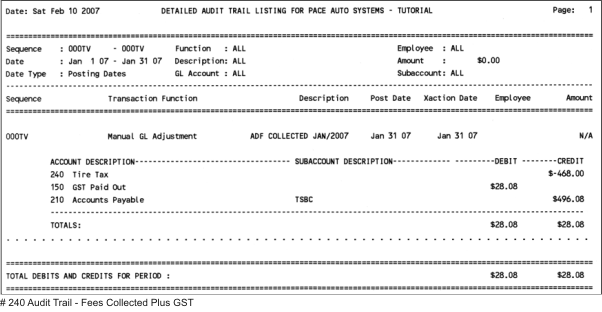

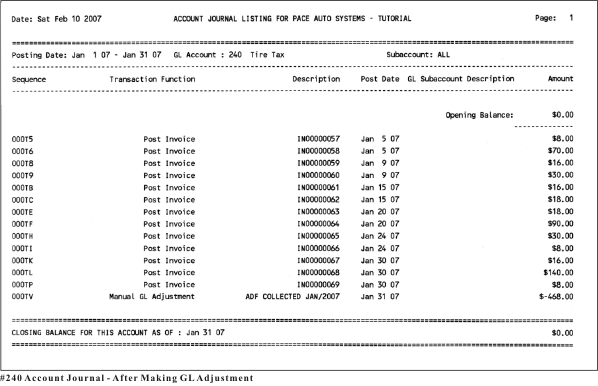

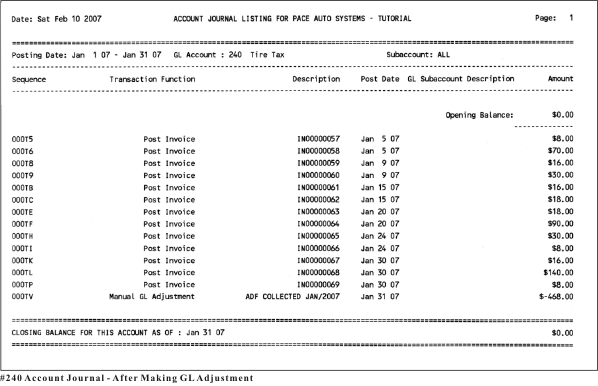

Run an account journal on account # 240 for the month of fees collected

Date your computer to the last day of that month

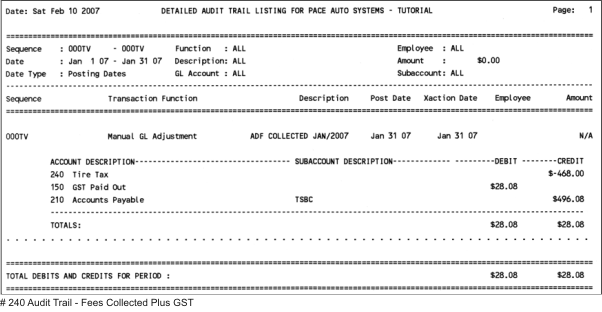

Do a Manual GL Adjustment to claim the GST tax credit and transfer the amount to the payable account.

Reset the computer date to the actual date.

Calculate the quantity of tires sold by dividing the amount collected (before GST) by the fee price. Eg: $468.00 collected divided by $4.00 fee = 117 tires sold.

On the Supplier account, select Make A Payment.

The problem with this approach is that you will only be able to provide an auditor with the results of an Account Journal report (# 240) which lists the invoices, not the actual count of tires sold. Also, it won't work if the business sells other categories of tires, which have different fee levels.

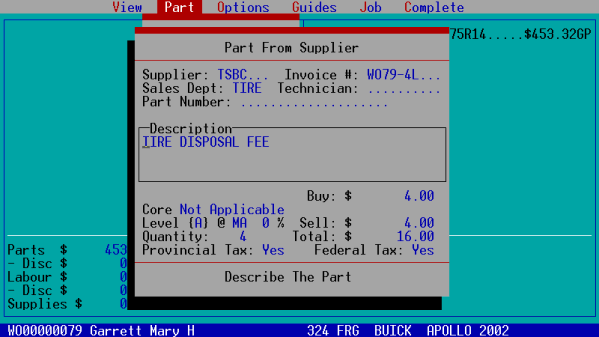

2. Supplier Account Method

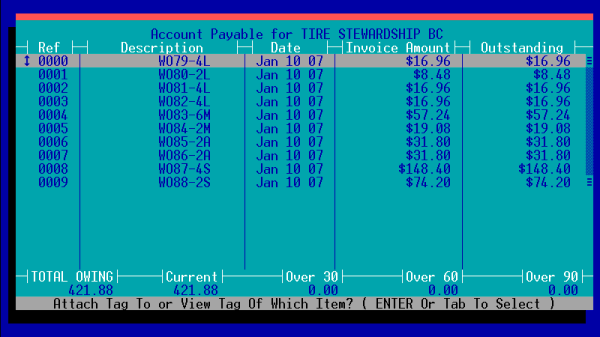

You will be making a supplier card for the stewardship company to make the remittance, this also provides a payable account. The account could keep a record of the fees collected, work order #, the number of tires sold, the fee category and remittances.

Procedure:

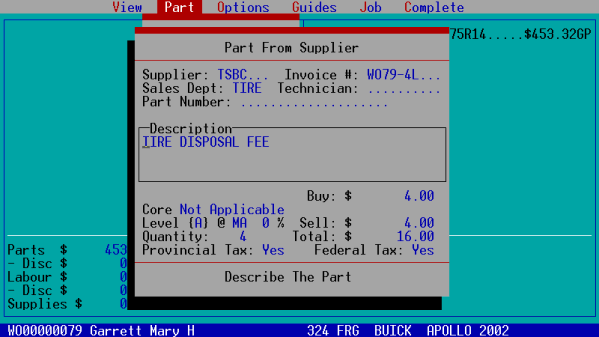

Position on the work order

Select "Part From "Supplier"

Supplier = TSBC (or whatever code you have chosen)

Invoice # = the work order #, the quantity of tires sold, and a letter for the fee category

Enter the cost ie, $4.00 for passenger tires in BC

Enter the sell price to equal the cost ie, 0% profit

Enter quantity

Charge PST & GST (in BC)

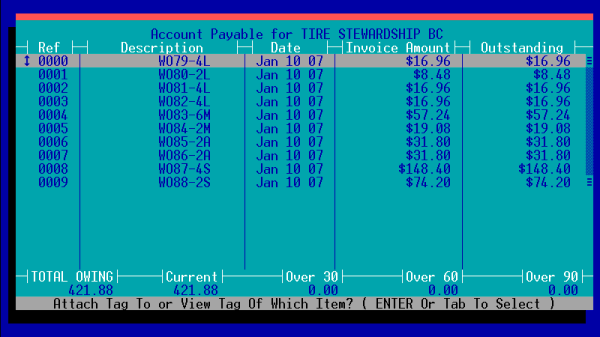

The result will be that the payable account will show a list of all work orders (with tire fees), the quantity of tires sold, and the fee category as well as the amount owed to the Steward co.

The account will list the amounts with gst so the bookkeeper will have to make the calculation for separating the fee amount and gst to fill out the remittance form:

To find the gst - use total amount and multiply by .0566.

To find the fee amount - use the total amount and divide by 1.06

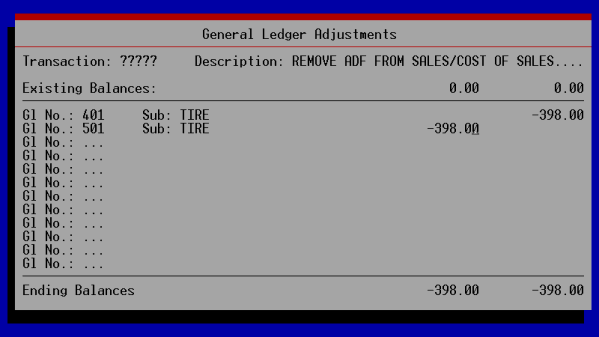

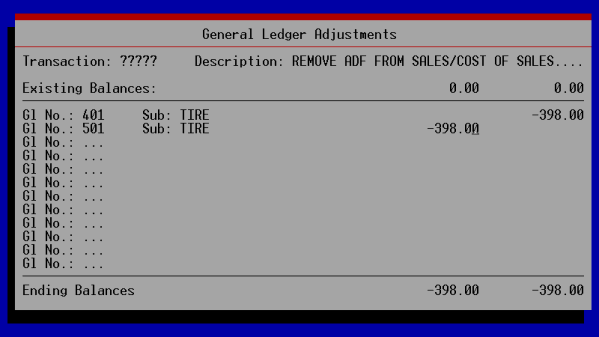

This method will inflate the revenue and costs of the sales department but may not be a material amount. If, however, the sales department does need to be corrected then a simple gl adjustment to reduce sales and cost of sales will be required

The report (supplier account) would have to be printed at the end of the last day of every month and saved, presumably attached to the remittance form. The remittance itself is a simple "Make A Payment" on the TSBC supplier account.

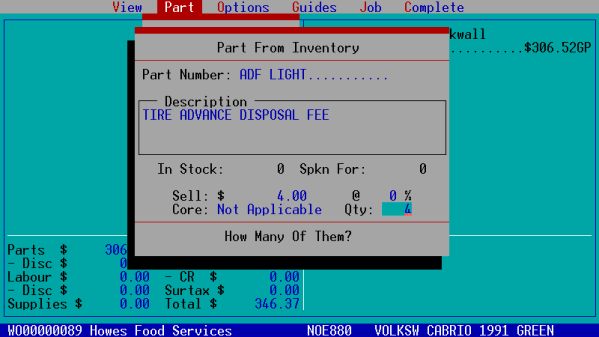

3. Inventory Card Method

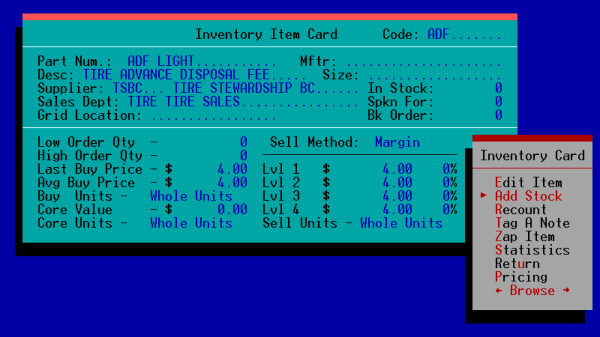

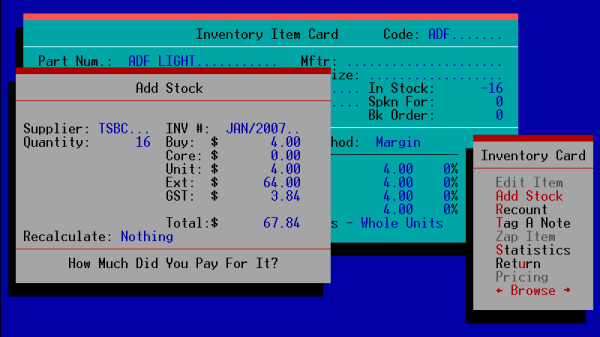

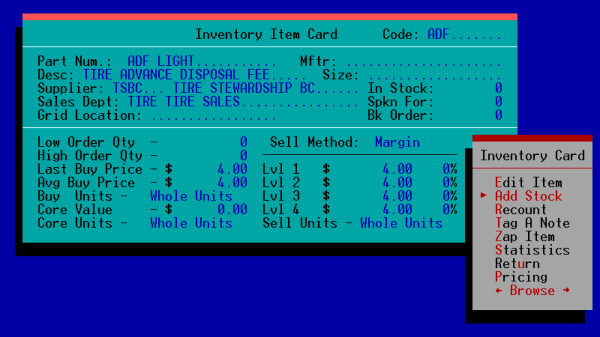

This procedure requires setting up an inventory card, let's call it "ADF LIGHT". In BC you will set up 1 card for each category of tire sold, eg: "ADF AGRICULTURE", "ADF MEDIUM" and "ADF SKIDDER". Enter relevant information and set the "Buy" and "Sell" prices to result in zero profit.

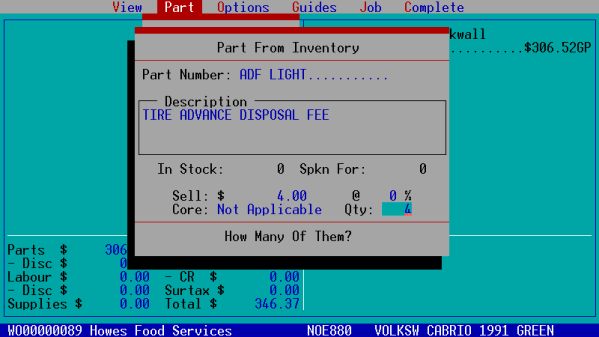

Procedure:

Position on the work order

Add part from "Inventory", eg, "ADF LIGHT" and enter quantity

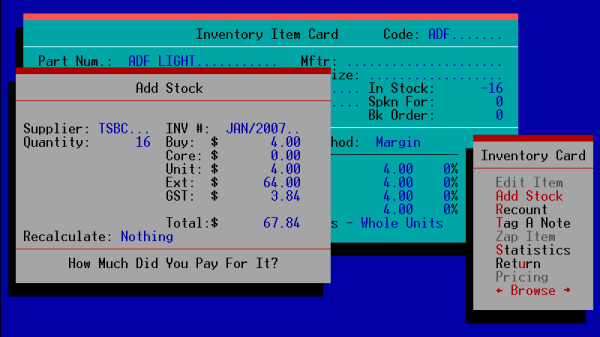

The inventory card will go negative

On the last day of the month the bookkeeper will go to the inventory card(s) and "Add Stock" to make the "In Stock" amount equal to zero.

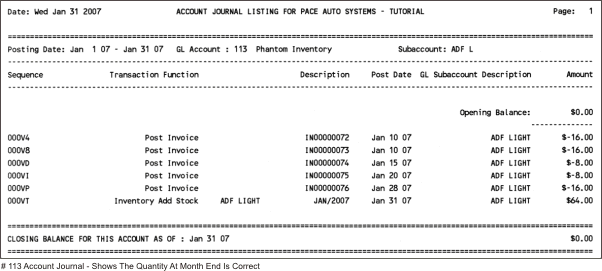

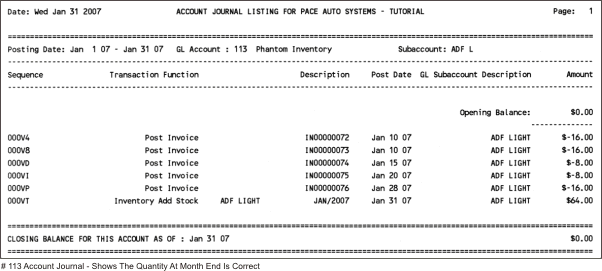

An account journal on account #113, "ADF LIGHT" will show all invoices and "Add Stock".

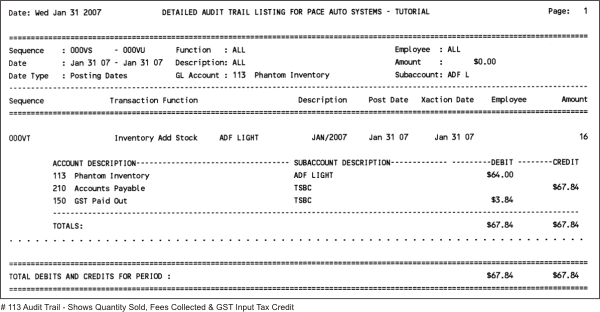

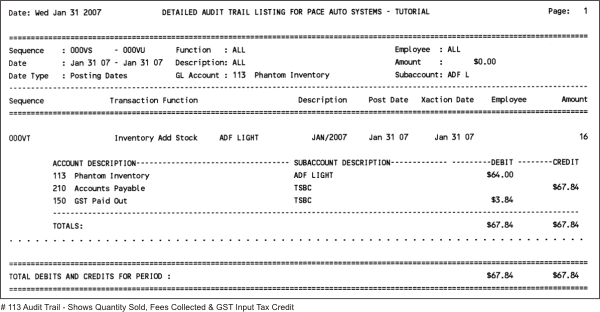

An audit trail report of the add stock transaction will show the quantity added, which is the number of tires sold.

Like the Part From Supplier method, this method will increase the Sales/Cost OF Sales of the sales department. If the amount is material then the same gl adjustment will have to made.

The remittance itself is a simple "Make A Payment" on the supplier account.

4. Levy System And SQL Method

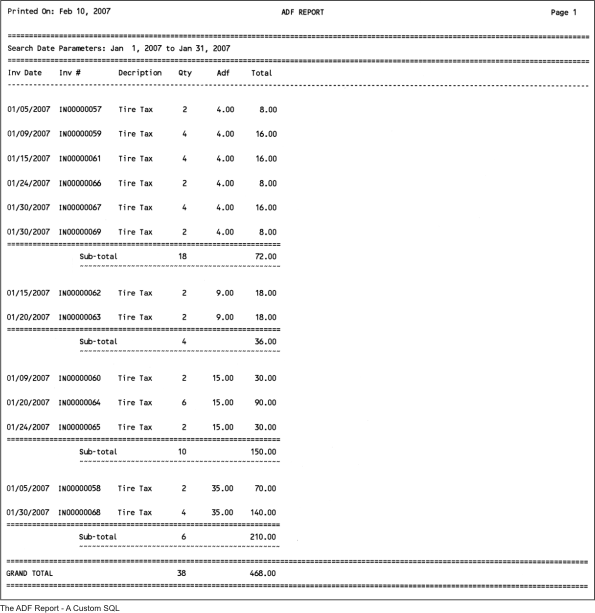

This method is like the Levy & Calculate' system at the beginning (#1). The difference with this method from the first is that the bookkeeper runs an sql to provide the reports needed for remittance and does not have to do any calculations.

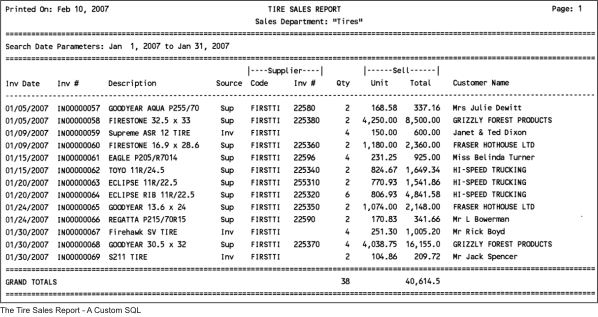

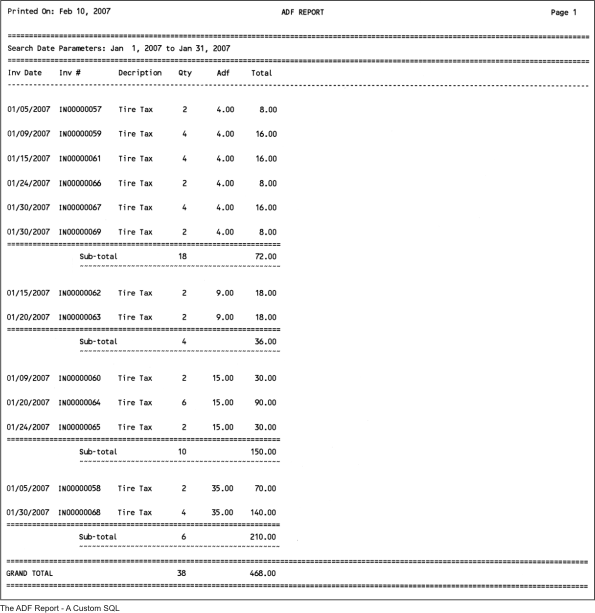

The first report shows the ADF entries to account #240 (Tire Levy). You can see the information reported in the picture below. A unique feature of this sql is that it groups the ADF by the fee category. This grouping is based on the amount of the ADF charged.

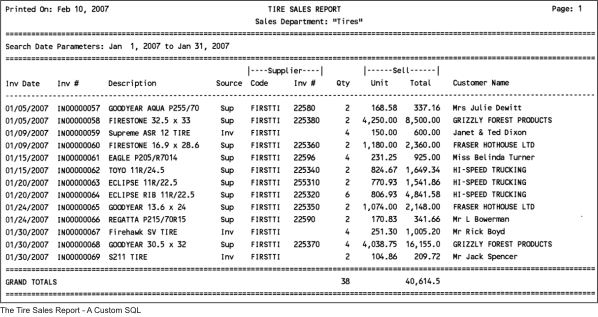

The second report shows the contents of the "Tire" sales department and can be used to cross-check the ADF report. Another major advantage of this system is that because the report can be run at any time, the bookkeeper can make the gl adjustment anytime before the remittance as long as the computer is back-dated to the last day of the month.

Both of these reports are produced with one sql. The user simply presses [Shift] [F4] and selects the "Tire ADF" report. To learn more about sql's please see the "SQL" page of this website.

The cost for this sql is CDN $35.00. Please contact me (email at the top of this page) if you are interested in implementing this method.

Summary Of Advantages vs Disadvantages

1. Levy System and Calculate

a. Advantages

i. No change in counter procedure

b. Disadvantages

i. Cannot provide a list showing quantity

ii. Does not work if shop sells more than passenger tires

iii. Must do a Manual gl adjustment each month

2. Supplier Account

a. Advantages

i. Able to produce list of workorders, quantity and fee category

b. Disadvantages

i. Must produce the "Detailed Payables" report at the end of the last day of the month

ii.Will have to do Manual gl adjustment to reduce Sales/Cost Of Sales if important

iii. Counterperson will have to pay attention to entering information

3. Inventory Item

a. Advantages

i. Account Journal shows Invoices, and inventory addition (value of ADF collected)

ii. Audit Trail report shows quantity of tires sold

b. Disadvantages

i. "Add Stock" must be done at the end of the last day of the month

ii. Will have to do Manual gl adjustment to reduce Sales/Cost Of Sales, if important

4. Levy & SQL

a. Advantages

i. No change to counter procedure

ii. Able to produce a report showing invoices, quantity, ADF by fee category and grand total

iii. Able to produce a list of invoices, tire size, quantity and other information

iv. Can be printed at any time for any period, thus avoiding the "end of the last day of the month" tasks.

b. Disadvantages

i. Must do a Manual gl adjustment each month